[ad_1]

New Delhi26 minutes ago

- Copy of Link

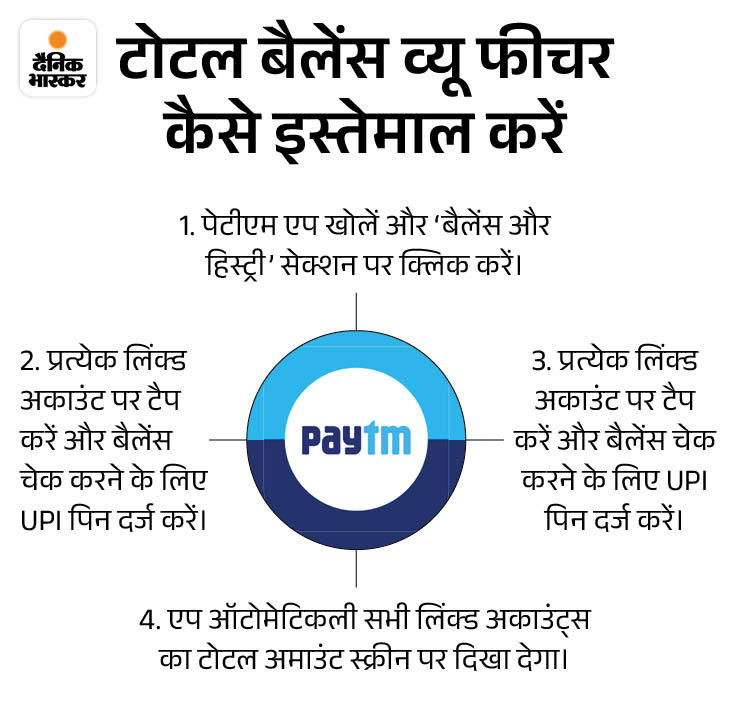

Paytm users will now be able to check the total balance of all their bank accounts by keeping the UPI PIN only once. For this, the digital payment company Paytm’s app has launched a new feature ‘Total Balance View’. The total amount of all accounts linked to UPI from this new equipment can be seen on the same screen.

This feature is especially useful for those who have multiple bank accounts and they check the balance by going to different applications. With this feature, users will no longer need to add the rest of the various bank accounts.

Money will be easy to manage

The purpose of this new equipment is to make money more easier by eliminating the need to test the balance of different accounts individually. This is, you will be able to work easily on financial plans, budgets, control and conservation.

Paytm started in the 21st

The Paytm Payment App was launched on August 25 by Paytm’s main company One 97 contact. Its founder is Vijay Shekhar Sharma. Currently Paytm has more than 5 million users in the country. Paytm’s market cap is about Tk 20,000 crore.

NCPI operates UPI

RTGS and NEFT payment system operations in India are with the RBI. The National Payment Corporation of India (NPCI) operates systems like IMPS, Rupe, UPI. From January 1, 2021, the government had a vacant frame framework mandater for UPI transactions.

How does UPI work?

For UPI services, you need to prepare the Virtual Payment Address. After that it will have to be linked to the bank account. Next, you do not need to remember your bank account number, bank name or IFSC code, etc. Payment bus processes the request to pay according to your mobile number.

If you have its UPI ID (e-mail ID, mobile number or Aadhaar number), you can easily send money through your smartphone. Not just for money for net banking, credit or debit card, but also for utility bill payment, online shopping, shopping, etc. You can do all this through the Unified Payment Interface System.

[ad_2]

Source link